Abstract

In November 2021, CCSAA and Snow Sports Insights conducted a survey of cross country skiers to ask them about their plans to participate in a variety of winter outdoor activities and to shop for the holidays. This report summarizes what we learned about their plans, what we learned about their self-perceptions, what happened on Black Friday and Cyber Monday, and what we can expect from core cross country skiers this winter.

Introduction

According to the latest participation data there are 4.8M cross country skiers, but more than half of the U.S. population, 160.7M Americans participate in outdoor recreation activities including skiing, mountain biking, sledding, hiking, snowshoeing, trail running, and walking outdoors (PAC Participation Study 2020, SIA 2020). We surveyed more than 1,000 cross-country skiers in late November to learn:

- What activities they plan to participate in during the winter months of 2021-2022

- When they plan to participate

- How far they plan to travel to participate

- What mode of travel they plan to use to get there

- What they plan to shop for during the holiday season

- Where they plan to shop

- Who they plan to shop for this holiday season

- How they describe themselves

Executive Summary

The cross country skiers we surveyed participate in many different winter activities including walking outdoors, running on road and trail, hiking, biking, snowshoeing, and sledding just to name a few. More than 80% of respondents plan to purchase outdoor apparel and 76% plan to buy equipment this holiday season. The majority plan to shop at brick-and-mortar specialty shops. Overall, 58% said they plan to travel more than 100 miles to participate in outdoor activities this winter and the majority will get there in a car. Finally, keeping last winter’s pattern intact, respondents are working in flexible environments that allow them more time outdoors and they plan to participate in cross-country skiing and a wide variety of outdoor winter activities as much or more during the week as they do on weekends.

The sizes of the boxes below represent the popularity of various winter activities enjoyed by cross country skiers:

Retail Sales – Black Friday and Cyber Monday Results

General Black Friday retail sales were down 1.1% this year. “Traffic at retail stores on Black Friday dropped 28.3% compared with 2019 levels. Traffic was up 47.5% compared to 2020. The total amount of spending on Black Friday was down slightly from 2020, a drop from $9B to $8.9B.” (Sensormatic Solutions and CNBC) Cyber Monday sales have been higher than Black Friday sales totals for most of the past decade and in 2021, Cyber Monday sales exceeded Black Friday sales totals by $1.7B. Cyber Monday 2021 brought in $10.7B in eCommerce sales but were down 1.3% compared to Cyber Monday 2020.

Cross country skiers are not bucking the general trends in shopping behavior. Half of the respondents said they are planning to buy equipment and apparel and another 30% are considering buying – depending on what they can find in-stock. Many of the respondents who said purchases weren’t definite commented that they weren’t sure about the availability of items they most want and cited worries about supply chain issues.

The Covid-19 pandemic continues to affect shopping behavior in 2021, about one third of respondents plan to shop and purchase online rather than in a brick-and-mortar shop. We expected to see the percentage buying directly from brands’ websites soar, but just 9% said they would buy directly from brands or brand outlets. We had an abundance of comments in the “other” category about purchasing online from retailers and picking up purchases curbside.

If you want your products to get maximum exposure to cross country skiers, get them into a gear guide, explain the product well on your website, and make sure retail staff are well versed on your products. Considering the costs of marketing outdoor products during the holiday season in the run-up to winter, we asked respondents to tell us where they do their research before buying outdoor products. Gear guides won by a very narrow margin followed by advice from retail staff, and advice from family and friends. Brand websites were a valuable source of information for about 1 in 3 outdoor enthusiast shoppers. Social media including YouTube, Instagram, TikTok, SnapChat, and Twitter were consulted by 20% of respondents, and athletes’ endorsements were considered by just 16% of respondents.

Flexible Work and Mid-Week Participation

In April 2020 when the Covid-19 pandemic impacts on the workforce became clear, more than 80% of white-collar employees and 19% of blue-collar employees were working from remote locations. Those numbers have decreased, but more than 65% of the white-collar workforce continues to work from remote locations at least part of the time and more than 1 in 4 work remotely 100% of the time.

More flexible schedules have allowed cross country skiers more time to access their favorite activities during the week. In fact, the percentage (26%) who report working 100% from the office matches the general results from Gallup (shown above) exactly.

Last season, we saw the uptick in mid-week participation in skier-rider visits during weekdays according to the 2020-2021 NSAA Kottke End of Season report. Respondents to this early season 2021-2022 survey confirmed their intention to participate in cross country skiing and other winter outdoor activities during the week. In fact, survey results indicate that participation will be slightly heavier during the week than on weekends, if respondents stick with their plans. This has major ramifications for the commitment of resources at cross country trails.

Among cross country skiers (chart below is specific to cross country skiers), 59% said they plan to travel more than 100 miles to participate in cross country skiing and other winter activities, and most will drive to get there. The activities they were most likely to fly to a destination for were downhill skiing and snowboarding, and mountain biking.

Outdoor Winter Recreation Participant Profiles

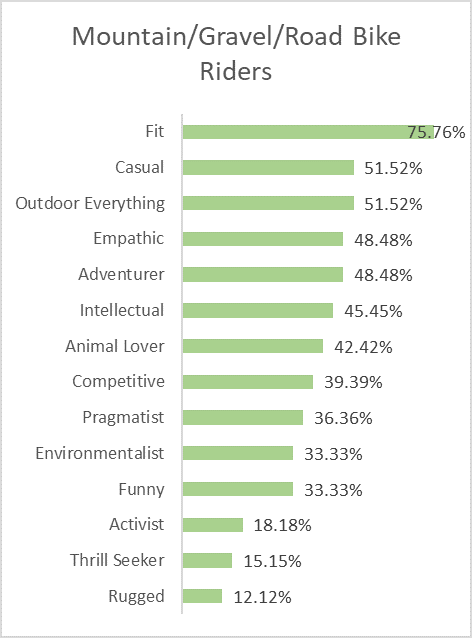

Building participant profiles that help target customers is key to efficient and effective marketing campaigns and understanding how customers see themselves is key to that effort. We asked all of the survey respondents (cross country skiers, downhill skiers and riders, cyclists, runners, hikers, walkers, etc.) to choose from a list of descriptors that best define them. In the analysis, we broke this down based on the activity respondents said was primary to them. The results revealed subtle differences in self-perception in each activity. For example, trail runners see themselves as extremely fit, adventurous, and competitive while road runners see themselves as fit, outdoor everything, environmentalists. Hikers see themselves as mostly casual, and despite stereotyped ultra-fitness, cross country skiers see themselves as primarily casual and secondarily fit. Here are a few of the self-perceptions by activity:

Conclusion

The winter of 2021/2022 promises to be an interesting season complete with La Niña conditions that should bring colder and wetter weather to the northern half of the U.S. and Canada; potential for a resurgence of the Covid-19 pandemic due to variants of the virus like “Omicron” which may have resistance to vaccines, massive workforce upheavals, and inflationionary pressures. In other words, it’s hard to predict what the winter of 2021/2022 will bring, but we know that cross country skiers will be there. They’re out there right now studying gear guides and getting advice about what to buy, and they are buying equipment and plenty of new apparel for their adventures. They will drive a lot and fly a little less to get to destinations where they will ski, bike, run, snowhoe, camp, and fish this winter. They will be fit, they will be intellectual, they will be adventurous in the outdoors this winter.

Methodology and Limitations

This survey was conducted from November 18-29, 2021 using a panel of participants who had taken part in at least one of the winter activities listed below more than 1 time last winter. The list includes the following activities:

- Walking outside

- Hiking

- Road/Mountain/Gravel Biking

- eBike Riding

- Fat Bike Riding

- Trail Running

- Road Running

- Camping

- Hunting

- Fishing (salt/fresh/ice)

- Downhill Skiing

- Snowboarding

- Cross country Skiing

- Alpine Touring (Ski or splitboard)

- Snowshoeing

- Sledding

- Snow Machine Riding

- Wildlife Viewing

This survey was conducted online by invitation only to approximately 5,000 potential respondents. We received 401 completed and validated responses from cross country skiers. The margin of error of +/-4.45.

Limitations

The sample did not include any responses from new participants – those that have never participated before but intend to participate this winter.