In early January, the Cross Country Ski Areas Association and Snow Sports Insights conducted a survey of cross country ski areas to get a reading on how the season is going so far. We learned that season pass sales are up, day pass sales are down slightly, demand for rental equipment is up, retail sales at ski areas are up, and lesson sales are up.

Season Pass/Day Pass Sales

53% of the ski areas and clubs responding indicated that season pass sales are up and over half of the ski areas that are seeing season pass sales growth have double digit growth. This result indicates that the skiers who started cross-country skiing or came back to cross country skiing after a participation lapse have come back for more.

Day pass sales are slightly down overall, but 1 in 3 ski areas have increased day pass sales. Comments and anecdotal data suggest that some of the declines are attributable to lack of snow in certain areas of North America.

Rental Sales

Demand for rental equipment is up so far this season with more than half of reporting ski areas seeing increases. Some cross country skiers couldn’t find the equipment they wanted to buy, so they have been forced to rent this season. Yet another side-effect of supply chain disruption.

Retail Sales

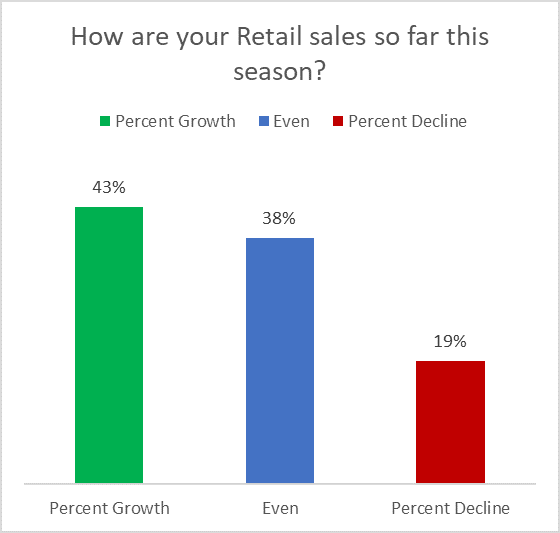

Retail sales are up so far this season at 43% of ski areas that have retail shops, while 19% see sales declines in their retail shops through January. Supply chain disruption may be the root of this issue, some retailers are struggling to get product into the store to offer to customers.

Lesson Sales

Lesson sales are up this season at 43% of the ski areas that responded. Good news for those waiting to see if we would continue to build the cross-country ski participant base in 2021/2022. About one in every five ski areas reported a decline in lessons compared to last season. The ski areas with lower retail sales also had low lesson sales indicating that it isn’t lack of interest driving declines but lack of snow.

Season Passholders vs Day Passholders

We asked cross country ski areas to compare the percentage of season passholders on trail to day passholders on trail. We learned that on any given day on the trails, more than 60% of skiers are season passholders.

Flexible Work Scheule

Prior to the pandemic, skiing was a weekend only activity for many participants. The pandemic ushered in a massive shift to remote work. It’s hard to determine how all of the alternative work arrangements developed during the pandemic will stick around, but as of September, 45% of all positions in the U.S. were classified as remote at least three days per week.

Weekday/Weekend Visits

Remote work and more flexible arrangements allowed many cross country skiers to visit trails conveniently on weekdays. They like skiing on weekdays and plan to continue to blur work and play throughout the day and across the week.

Regional Results

(Note: Regional results include the US and Canada)

Pass Sales

The Western region enjoyed the most success through early January this season compared with the Midwest and Northeast regions of the U.S. and Canada. Weather is the most critical variable here, where there is snow, there is more cross-country skiing.

Retail/Lessons/Rental

(Note: The scale for responses was a +/-100 pt scale with 0 at the median. It was designed to show growth and decline deltas)

Demand for equipment follows participation that follows the snow cover. Demand for rental equipment is high in the western region where more people are skiing due to better conditions. The same holds true for retail sales and lessons so far this season.

Weekday/Weekend

The Midwestern participant is most likely to ski on weekends. The Northeast is where the most even participation happens across all days of the week.

Conclusion

Overall, the 2021/2022 season is off to a good start. We are seeing retail sales, equipment rental, and lesson sales growth across North America but most prominently in the Western region where conditions are best so far this season. The increases in season pass sales and increases in demand for lessons, rentals, and retail indicate that cross country is retaining the new skiers and lapsed skiers who explored the trails last season.